Putting the above arguments together, we get this formula:

The fv and type arguments can be omitted since their default values work just fine for us (balance after the last payment is supposed to be 0 payments are made at the end of each period). For the pv argument, enter the loan amount ($C$5). Nper - multiply the number of years by the number of payment periods per year ($C$3*$C$4). Rate - divide the annual interest rate by the number of payment periods per year ($C$2/$C$4). To handle different payment frequencies correctly (such as weekly, monthly, quarterly, etc.), you should be consistent with the values supplied for the rate and nper arguments: The payment amount is calculated with the PMT(rate, nper, pv,, ) function. Calculate total payment amount (PMT formula) With all the known components in place, let's get to the most interesting part - loan amortization formulas.Ģ. In the Period column, enter a series of numbers equal to the total number of payments (1- 24 in this example): The next thing you do is to create an amortization table with the labels ( Period, Payment, Interest, Principal, Balance) in A7:E7.

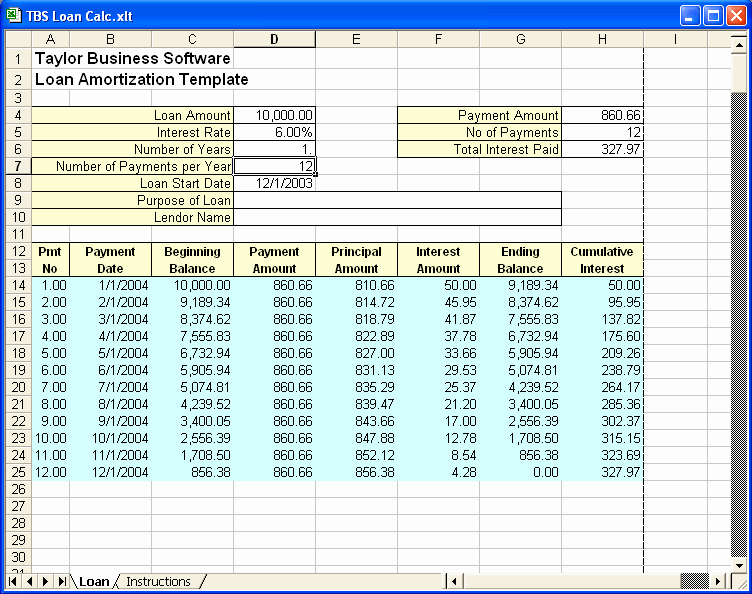

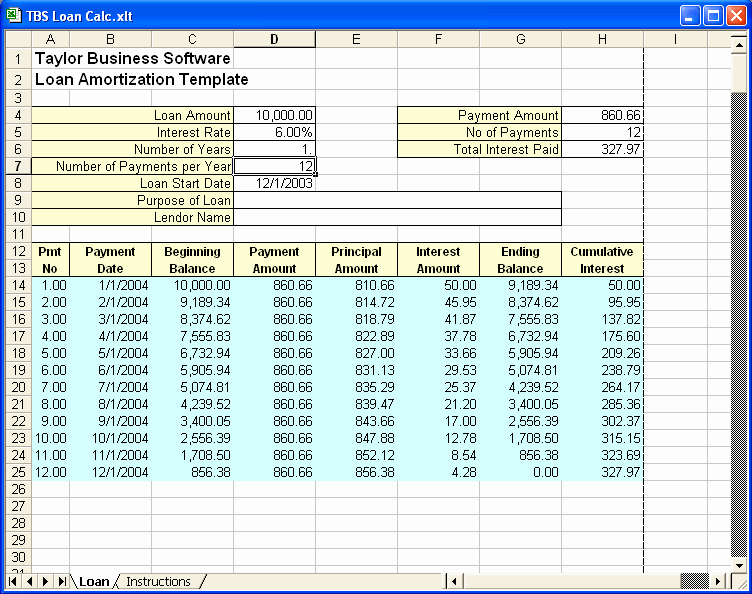

Set up the amortization tableįor starters, define the input cells where you will enter the known components of a loan: Now, let's go through the process step-by-step.

IPMT function - finds the interest part of each payment that goes toward interest. This amount increases for subsequent payments. PPMT function - gets the principal part of each payment that goes toward the loan principal, i.e. This amount stays constant for the entire duration of the loan.

PMT function - calculates the total amount of a periodic payment.

To build a loan or mortgage amortization schedule in Excel, we will need to use the following functions:

Free online amortization schedule how to#

How to create a loan amortization schedule in Excel

0 kommentar(er)

0 kommentar(er)